Features.

Capone is a complete collection platform, implemented in over 50 companies from several industries, all over the world. It has extensive features for the control, management and automation of all collection process in one place for independent use.

- End-to-end Technology

- 360° Overview

- Collection Strategies

- Configurability

- Multi-concept

- Artificial Intelligence

- Data Mart

- On-premise or cloud-based SAAS

- Scalability

- Integration

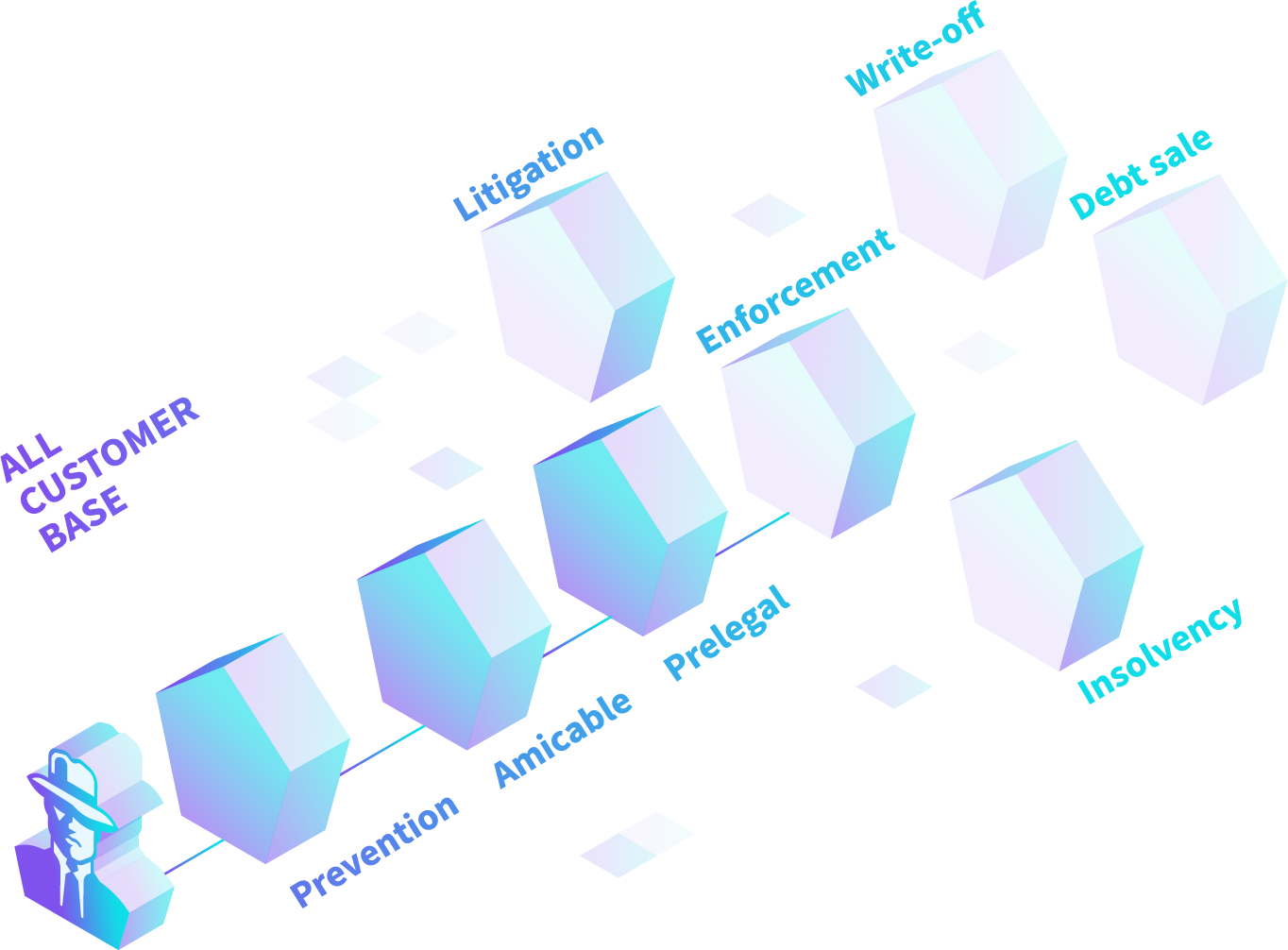

End-to-end Technology

Capone provides you all the necessary mechanisms for the entire delinquency lifecycle covering all collection stages. You can easily manage your whole customer base and product portfolio. Also, our technology facilitates both in-house and external treatments.

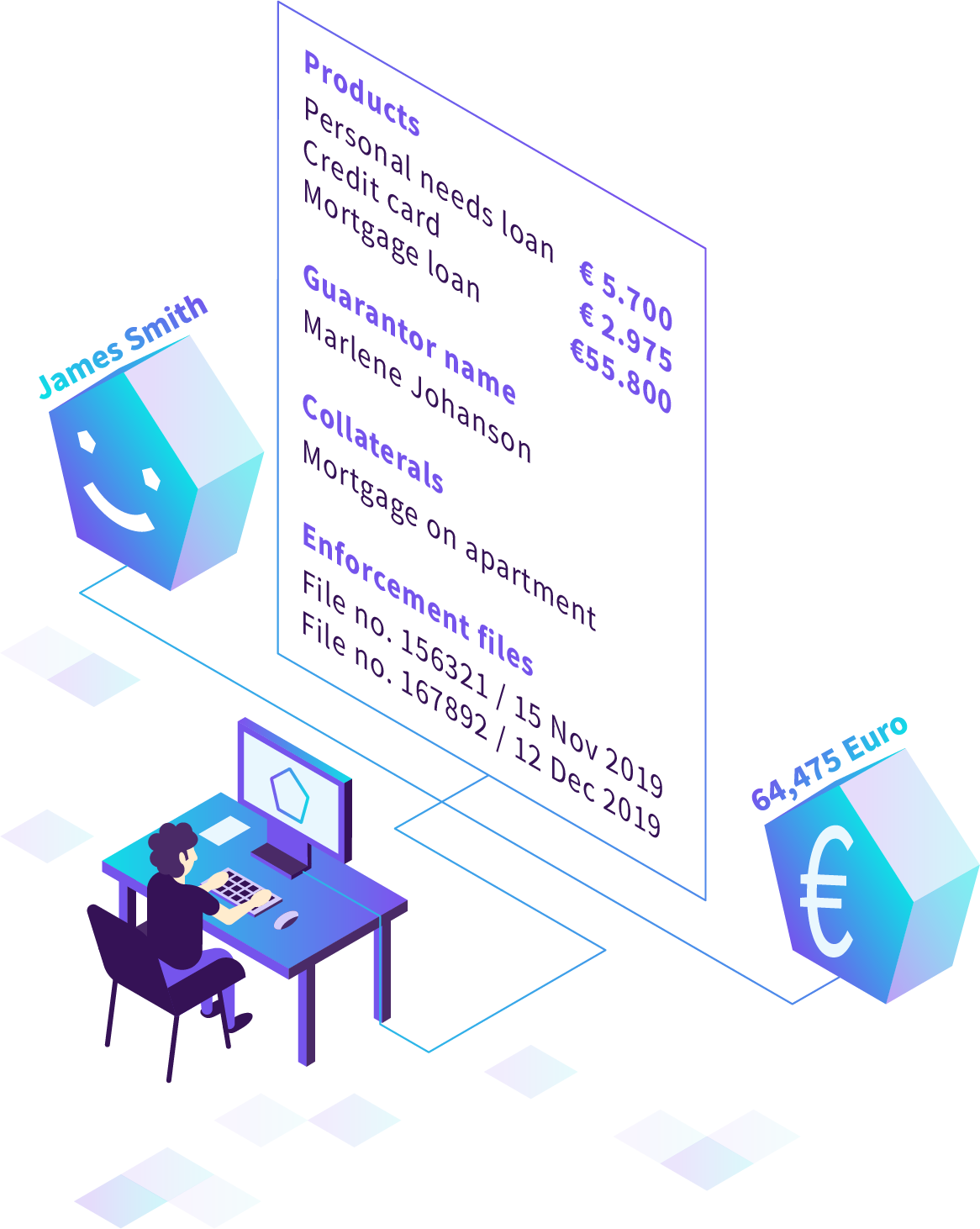

360° Overview

You have a clear and spot-on overview of the customer and the possibility to zoom into detailed information and collection entities’ relations. The configurable hierarchical levels accommodate multiple scenarios according to your industry specifics.

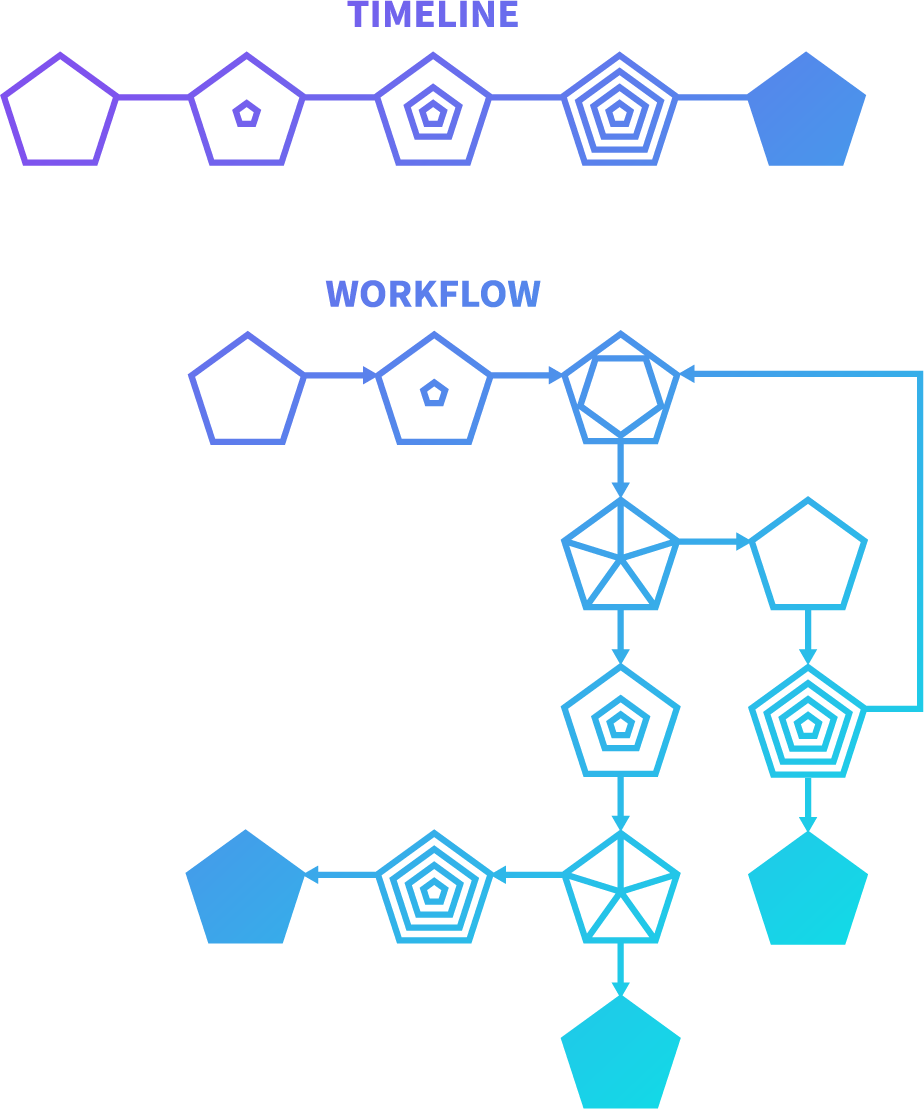

Collection Strategies

You can efficiently map the collection process using timeline or workflow strategies and actions, based on configurable criteria under your control.

The timeline strategies control the automation of your collection actions over a determined period of time, while the workflow strategies employ complex business processes, like legal or restructuring.

Configurability

The highly configurable technology of Capone grants you the autonomy needed to define and operate your collection processes and to develop operational reports and dashboards, on your own.

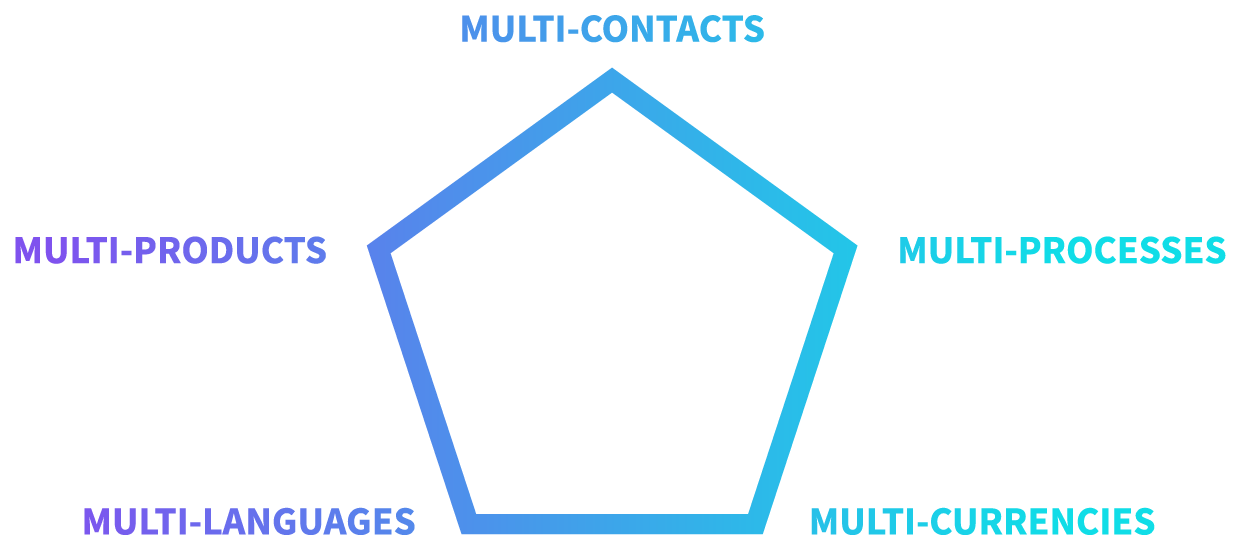

Multi-concept

Our multi-concept enables you to handle variety in your business like multiple geographic locations, languages, currencies, and also various products, contact data types, case owners and many others.

Artificial Intelligence

Capone uses state-of-the-art AI modules to enhance all debt collection processes. Smart Scoring predicts the likelihood of payment, DEX accelerates document processing and delivers key insights and Smart Strategy chooses the most effective collection actions. Capone gets smarter every day as we’re continuously developing new AI features.

Data Mart

This module helps you unlock your data's full potential, providing actionable insights and enabling informed decision-making.

On-premise or cloud-based SAAS

Capone has both on-premise and in cloud deployment options. It uses a web-based interface, compatible with most current browsers.

Scalability

Capone scales easily to cope with increased volumes and it needs low hardware resources for this, while supporting all kinds of high availability and disaster recovery scenarios.

Integration

Capone is usually very friendly with external systems, as we haven’t found one we couldn’t integrate with, out of the hundred types we encountered.

Industries.

We developed Capone as an adaptable technology for the specific needs of several industries, so it can become a fundamental part of any company’s collection strategy.

It provides a core solution that enables collection agencies to automate its services and processes.

It supports agile and technologically advanced companies to quickly implement dynamic collection strategies.

It helps banks to improve the process of recovering debts, while keeping collection costs down.

It creates a positive customer experience through specific collection strategies, addressing both billed and unbilled amounts.

Capone Start.

By presetting most of the parameters and processes necessary for debt collection, we have created a more accessible package, Capone Start, which has a shorter implementation time and comes in a friendlier budget.

All this, while maintaining the proven mechanisms and platform of Capone technology.

In 19 countries

by now.

All rights reserved.